Tough year for European virgin-polymer demand but underlying differences remain strong: AMI report

A new dataset from AMI Consulting shows the challenges facing the European plastics industry in 2022 and through to 2027. It covers all of Europe including Russia and former CIS countries.

GDP forecasts for 2022 still look quite healthy. The IMF in its October 2022 update forecast 2.6% growth for Europe in 2022, a figure that would be higher if Russia and Ukraine were excluded. Advanced Europe is expected to grow 3.2% this year.

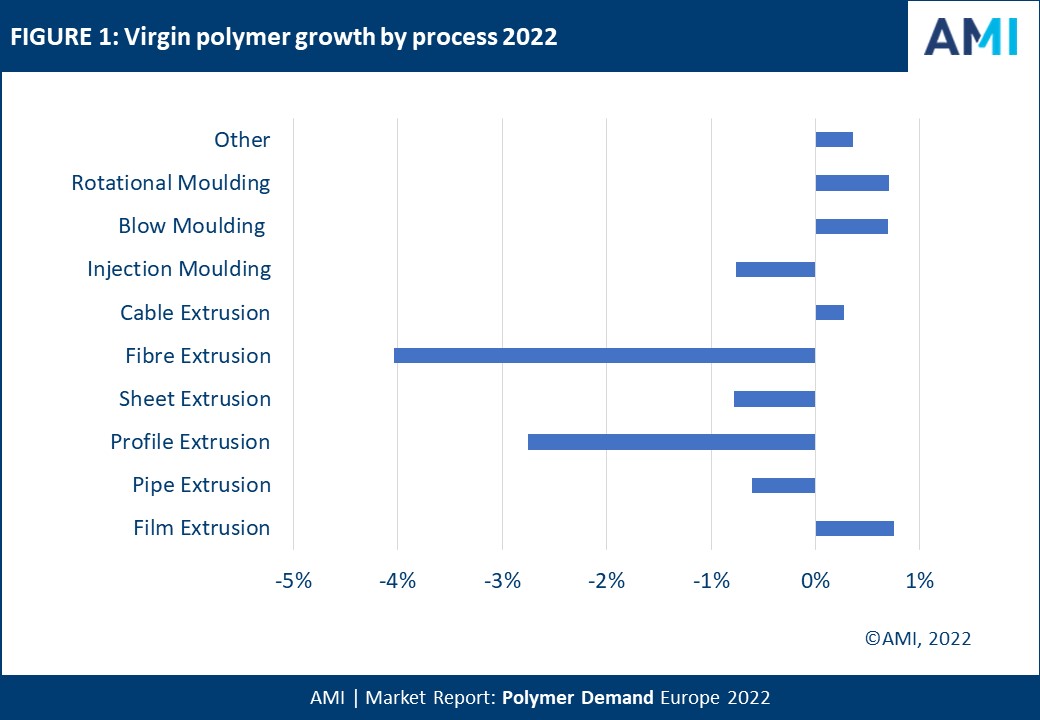

However, the virgin-polymer market looks less healthy with AMI forecasting a 0.4% decline in plastic consumption. This headline number hides wide differences between polymers, between processes, between countries and between applications (see bar chart above).

Segments of interest to roll-to-roll materials converters

The weakest process is fibre extrusion. There are two specific areas of fibres that are very weak 1) hygiene and medical nonwovens; and 2) carpets. Hygiene nonwovens have been a very strong market – especially in 2020. Masks, other PPE like draps and gowns and hygiene wipes, all saw very strong demand. Some of these were imported from Asia, but much was made in Europe and demand for spunbond machines was very strong. Now we are using less of this, equipment demand is falling off.

The strongest (or perhaps least weak) polymer application is film. Film production tends to be less sensitive to economic hardships than other sectors of the polymer market. Growth through the COVID-19 pandemic was steady, and that trend will continue up to 2027. There are also substantial differences between different polymers with films – with sustainability and changing consumer trends driving differential performance.