AWA conference reconnects global release-liner industry growing 3.4% a year through 2022

By Mark A. Spaulding

It took nearly two years, but the worldwide release-liner manufacturing supply chain reunited recently at the AWA Global Release Liner Industry Conference & Exhibition. This 21st edition of the event was postponed from its usual program last spring due to (what else?) the COVID-19 pandemic. But with 150 attendees in person at the University Club of Chicago (and another 85 participating virtually), the GRLICE covered a broad range of topics from market projections and industry leadership issues for suppliers & converters to supply-chain dynamics (or the lack thereof) and liner-recycling status and new developments.

Here's a handful of Converting Curmudgeon bullet "points-of-interest:"

- A highlight of the annual GRLICE, whether held in Europe or North America, is the Industry Leadership Panel. Mactac CEO Ed LaForge, Elkem Silicones VP-Sales & Marketing Bertrand Mollet, Mondi Sales & Business Development Director Jurgen Van der Donck and Bostik NA Business Director Jeff Ogren participated in the hour-long discussion.

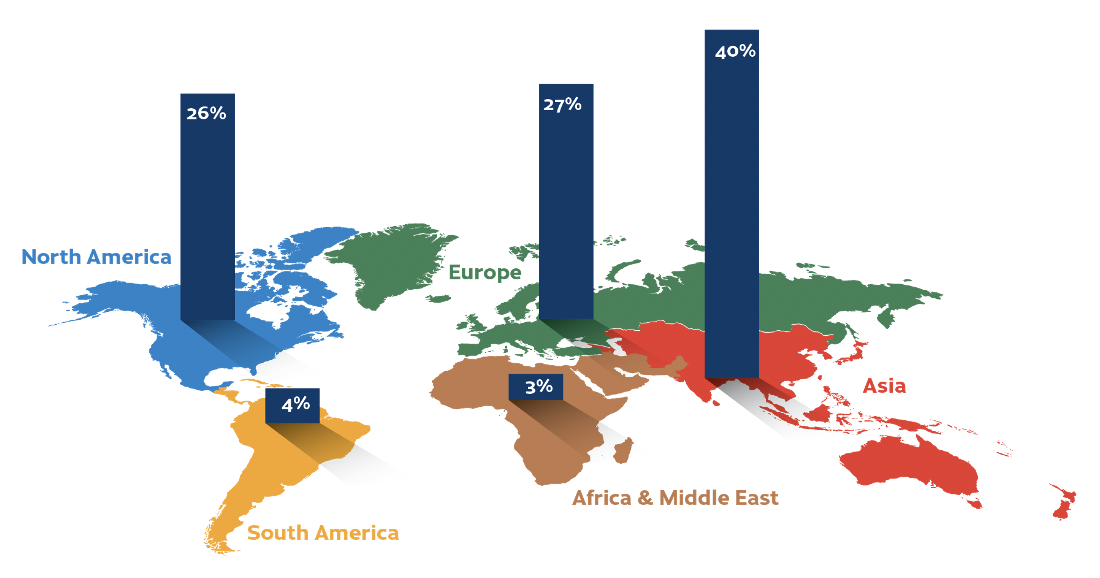

- The global release-liner market turned out 56.7 billion sq meters of material in 2020. Production market share by region is shown in the map above.

- For the first time, the percentage of the overall release-liner field taken by labelstock applications fell -- now down to 48% in 2020. This was due to combined increases by all other end uses. Other key apps include tapes, hygiene, graphic films and food & bakery.

- Glassine/calendered kraft paper continues to dominate release-liner substrates at a 36% share. Other papers make up the market at 16% for polyolefin-coated, 13% for clay-coated and 14% for other papers. PET was the strongest film substrate for release liners at 13% market share in 2020.

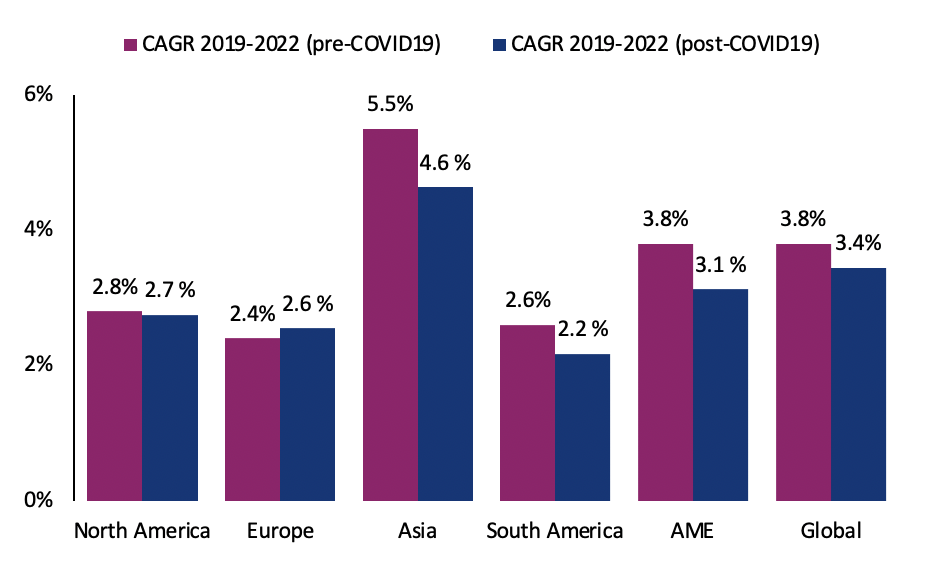

- Worldwide, the release-liner market will grow by 3.4% a year through 2022, down from a 3.8% CAGR projection pre-COVID-19. Other regional growth projections are shown in the bar chart above. Note the significant decline in growth forecasted for Asia, which still continues to lead the world in production volume.

- Post-COVID-19 growth for various end uses ranges from -0.2% for graphic films and only 0.8% for envelopes to 4.1% for medical and 3.9% for labelstock apps. Industrial uses show the greatest decline in growth pre- and post-COVID-19 from 4% down to 3%.

- Plenty of issues will keep plaguing the industry for the next few years at least. COVID-19 is not over yet (and certainly not with the latest variant coming out of South Africa). Supply-chain disruptions, teamed with tight labor markets, will make it harder for many companies to survive, let alone grow. And mergers & acquisitions will likely see even further increased activity in 2022 and beyond.