While p-s label stock demand across Europe was headed south at the end of 2019, the COVID-19 pandemic acted as a strong demand driver in the first half of 2020, especially for food, healthcare and supply-chain logistics labeling materials.

Edited by Mark A. Spaulding

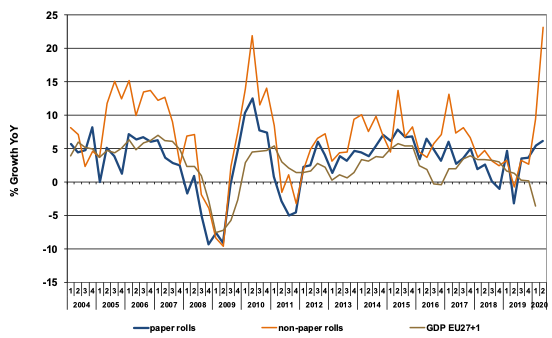

After two years of modest 1.5% annual demand growth in 2018 and 2019, European demand for pressure-sensitive (p-s) label materials has gotten a boost in the first half of 2020 from – of all things – the COVID-19 pandemic. Consumption of label stock in the wider European economic area was more than 8% above the level recorded in the same period last year. In the Q2 alone, demand for roll-film label materials even exceeded Q2 2019 by almost 25%, reports The Hague, The Netherlands-based

FINAT (

www.finat.com).

The incremental demand increase for label materials in the first half of 2020 was almost 320 million sq meters. More than half of this (53%) was composed of film-label materials

(see figure above). In relative terms, the most severely affected regions (UK, Ireland and Southern Europe) were behind the other (double-digit) regions but still recorded sizeable increases.

“A tale of fame and famine”

Strong overall demand in January (most likely reaching its peak in the first three months of the pandemic, with the European economy in lockdown) is attributed to the crucial role p-s labels play as enablers of critical infrastructure in times of crisis: food, healthcare, personal-care, sanitary products and supply-chain logistics. This was compounded by stockpiling at retailers and brand-owners, and that households in lockdown spent their spare time on home maintenance and home delivery of goods and services. Finally, with lockdown measures lifted, it’s easy to see how p-s signage plays an important part as “social distancing” markers, FINAT says.

Conversely, label demand in “non-essential” sectors such as automotive, electronics, travel and catering were suffering in the six months of 2020. The first two sectors also happened to record negative growth last year already compared to 2018, based on preliminary results from FINAT’s bi-annual RADAR Report. “Up until now, 2020 has been a tale of fame and famine for the industry,” says FINAT President Chris Ellison. “Certain parts of the industry could hardly cope with the excessive demand pressures; others had to rapidly adjust to a steep drop in demand in their sector.”

Survival vs. future investment

The fact that so far in 2020, short-term economic survival has prevailed over longer-term investment was not only apparent in consumer goods and services but also in the label industry’s investment projections. According to the same RADAR Report, label converters are tending to delay investment in heavy equipment until at least 2021.

Another view are the tensions at the operational level in production facilities that, on the one hand, had to cope with excessive demand for labeling anddelayed payments from customers, while at the same time deal with disruptions in raw-material supplies and shortages of staff due to COVID-19 restrictions and worker health issues.

Passing the stress test

During the latest online FINAT Briefing, a panel of industry leaders took stock of experiences from the past five months and offered an outlook into the second half of 2020 and beyond the pandemic.

“Our industry has passed the stress test,” says FINAT Board Member Ralf Drache. “In the overheated essential markets of the past few months, label companies have demonstrated their flexibility, resilience and agility. Our industry’s innate ability to respond rapidly to the disruptive circumstances has confirmed its role as a reliable partner, and this will open up new opportunities for more open, collaborative relationships along the supply chain.”