Global Linerless Label Market Volume To Grow Nearly 12% A Year To 2021

By Mark A. Spaulding

The linerless label segment of the worldwide pressure-sensitive (p-s) label market may today make up only 4% of the total field, but that small slice is expected to grow ridiculously fast – 11.8% a year to 2021. Details on this burgeoning development, a key part of today's AWAVirtual™ Linerless Labeling Seminar 2020, was provided by Anum Javed Beg, team lead-market research associate at AWA Alexander Watson Associates.

Here are some Converting Curmudgeon

"bullet points of interest:”

- The global p-s label market last year was up 3.3% to 26.5 billion sq meters to 46% of the total label market. Broken down by region, p-s label volume was 38% in Asia-Pacific, 30% in Europe, 25% in North America, 5% in South America, and 3% in Africa/Middle East.

- The 2019 linerless label market, specifically, accounted for 1.2 billion sq meters of material production. This was 600 million sq meters for variable-information printing (VIP) applications, and 577 million sq meters for primary-container decoration.

- Regionally, linerless label volume was 49% in North America, 43% in Europe, and 8% in Asia last year. Generally, VIP uses dominate in North America (62%) and primary-label uses lead in Europe (58%).

- Material-wise, linerless labels are converted via 75% paper and 25% plastic films. Paper is key for VIPs and films for primary linerless labels. By production details of p-s adhesive type, linerless labels are made using 70% hot-melts, 22% water-based, and 8% UV-curable hot-melt adhesives.

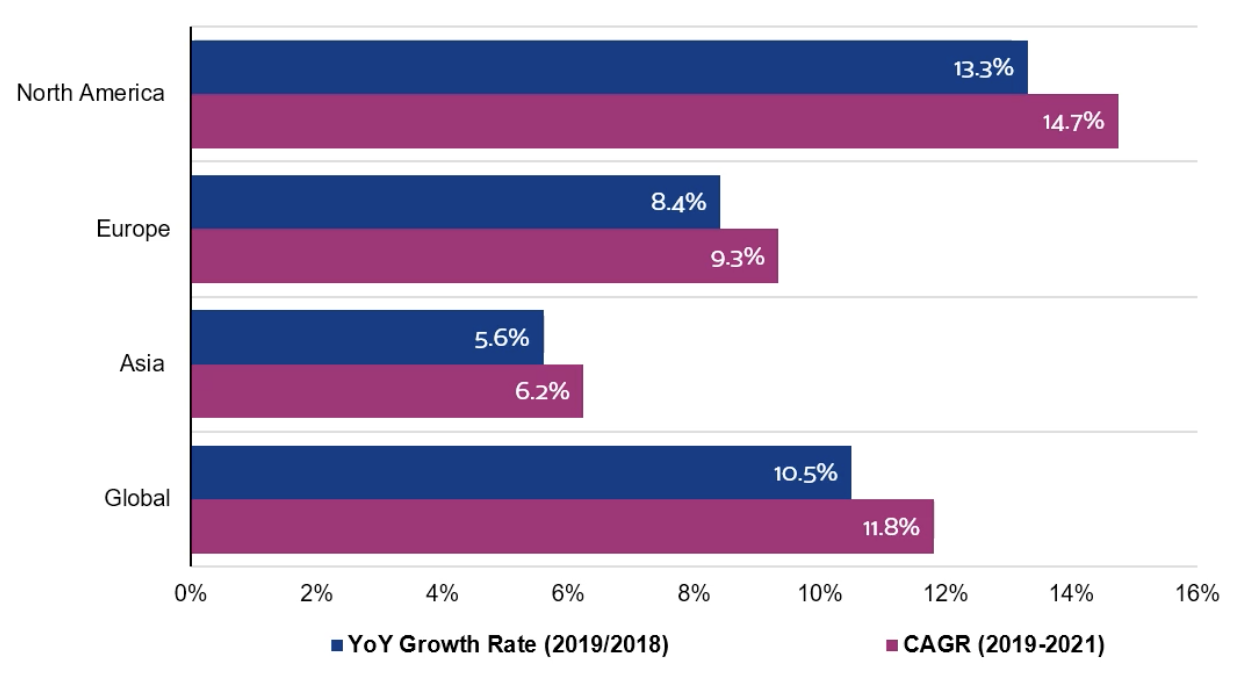

- As for future growth to 2021: Production will rise 14.7% CAGR in North America, 9.3% in Europe, and 6.2% in Asia – all of which will be mostly driven by greater VIP uses vs. primary linerless labels (see bar chart above).

The need for lower costs and better environmental credentials is driving up demand for linerless labels, says AWA. They are attractive due to there being more labels per roll, full-color printing possible on both sides of the label, less downtime on press for roll changes, less warehouse storage space required, lower transportation costs per label quantity, and lower overall costs due to no release liners.

Downsides to linerless labels, according to AWA, include very limited label shapes being possible, perforation technology is the primary method and often the only way to separate labels during application to containers, pre-coated labels with silicone and adhesive already set can be used only for VIP apps, quality for the above is limited to thermal-transfer ribbons and only one color – usually black; and there being a strong installed base of application systems for traditional linered p-s labels.

The COVID-19 pandemic has certainly had an impact on the linerless label market, Consumer purchasing trends have changed and may remain that way for years to come. Top buys are basic foods and drugs, hygiene and cleaning supplies at the cost of expensive non-essential goods. The threat of quarantines last spring drove stockpiling of basic commodities; and more home cooking is pushing demand for wraps/sleeve food packaging, which is the largest (36%) end-use application for linerless labels.

E-commerce growth due to home delivery before but especially now during the pandemic is driving VIP linerless-label demand in the transportation and warehousing logistics area, which accounts for 18% of end-use applications. Less money for roll transport tied with 2X more labels per roll for these print-and apply labeling needs are key positives for shippers and CPG product makers.